This is how international payments work

After carefully choosing your provider and opening your blocked account with Fintiba, you are probably wondering what the best and quickest way is to transfer money into the account.

We are living in a digital world where online purchases are possible 24/7 and instant money transfers can be made between two people at any given time and place. Thus, when it comes to the blocked amount transfer, many expect the same level of instant transactions and issuing of the blocking confirmation within hours of the transfer. However, the reality is that international bank transfers work differently and usually take a lot longer. Here are the reasons why.

Instant payments – what happens here?

Instant payments are based on transfers made in a closed circle or eco-system. For example, if you want to send $10 to a friend to pay them back for money they lent to you, and you both have a PayPal account you can transfer the relevant amount from your account to the account of your friend, both of which are part of the PayPal eco-system.

So, for instant payments the magic word is “eco-system”. Within the same eco-system, you can instantly transfer money between people and companies even if the sender and recipient are in different countries. However, both – sender and recipient – must be a member of the same eco-system.

Traditional international bank transfers – what`s the difference?

As discussed above, instant payments are very convenient, however traditional bank transfers are sometimes needed to transfer funds in different currencies and across countries.

Companies, which offer instant payments within an eco-system, usually focus on payment services only. They often do not offer classic bank accounts or additional services. In addition, the money held in accounts of such payment service providers are not covered by deposit protection guarantee. This means that if something happens to the institution, the account holders are not guaranteed to receive their money back.

Therefore, it is not possible for such payment service providers to issue a blocking confirmation, which is required within the visa process. With respect to the blocked account this means that traditional banks need to be involved in the process of transferring money. This leads to a more complex process, but also ensures the security of your funds.

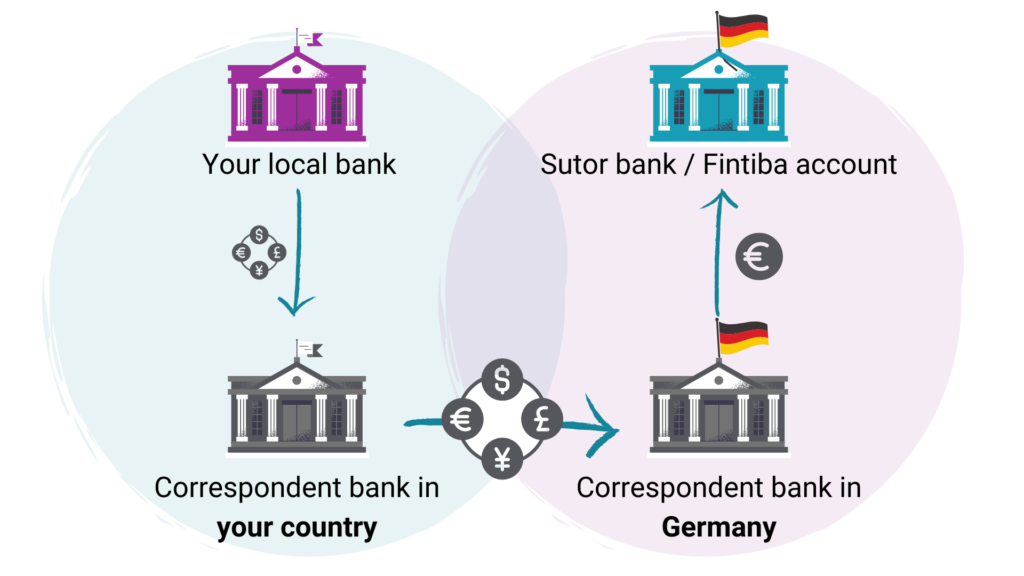

There are a lot of banks operating around the globe and it is not possible that each has a direct relationship with all the other banks. Therefore, banks established a correspondent banking system. In this system, smaller local banks hold accounts with bigger banks in their own country, who then make payments to a banking partner in the home country of the recipient. In the next step, this banking partner transfers the funds to the local bank of the recipient. We have illustrated how a regular bank transfer of the blocked amount to us could look like below:

Although this process looks somewhat complicated due to the number of banks involved as intermediaries, it still is more efficient then asking every single bank to establish a direct link with any other bank around the world, which would also be quite cost intensive.

As so many parties are involved, banking and regulatory institutions developed a binding framework for all participants. It ensures that payments can be properly made. This includes exchanging information regarding the sender and the recipient, as well as agreements on timelines for clearing the payments between all participants.

Although this framework is set, it is still possible that payments require a longer period to reach the recipient. It can take 2 weeks or even more in some cases. First, you must consider that banks involved in this process are acting in different time zones, which could cause delays depending on when they get the initial transfer information. In addition to the chart shown above, it could be that on either side of the payment flow there are more banks involved, especially if the bank where the sender keeps his account is a small entity and has no direct link to an internationally acting correspondent bank. This means that at least one additional bank in the sender`s country will be involved in the transaction.

Don`t worry if this process seems confusing! The most important point to remember is that the system was established to make sure that the money you transfer is safe and will be received in the account where you have sent it. Just be patient and make sure to start the transfer process on time to ensure that you will receive your blocking confirmation before your visa appointment.

Frequently Asked Questions and Answers:

1. Can Fintiba give me updates on the status of my international transfer?

Unfortunately, as the receiving bank we cannot give you an update on the status of your transfer, until it has actually reached your blocked account. We are also not able to speed up the transfer process. Thus, we recommend that you inform yourself about the general waiting times for international transfers (read the FAQ below) and start the process as early as possible, in order to receive your blocking confirmation in time for your visa appointment. As soon as the transfer has reached your blocked account, the blocking confirmation is automatically issued and uploaded to your Fintiba account, and you are informed accordingly.

2. What is the fastest way to receive my blocking confirmation?

A SEPA transfer from a bank in Europe to your blocked account usually takes 1 to 2 business days.

For international transfers we recommend using Fintiba Transfer, which usually takes 2 – 4 business days to reach the blocked account. Please note, that this service is not available for job-seeker visa applicants.

Regular international bank transfers may take up to 10 business days to be fulfilled.